How to Live Rich in 2019 – New Years Resolution 2019 –

Each and every day we provide you with the tools and deals you need to save on your groceries. The opportunity to save thousands of dollars is right there at your fingertips. It’s truly amazing how much you can save if you put your mind to it.

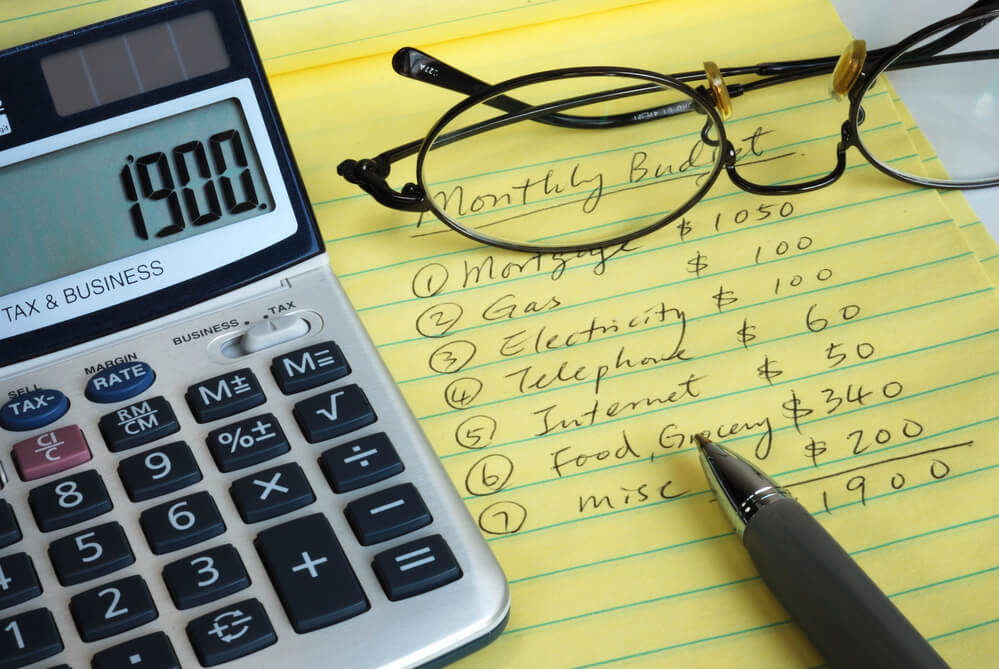

But, with the start of the New Year, I want you to be able to focus your thoughts on how to better manage your money and truly Live Rich with Coupons. What a waste it would be to do all that work clipping coupons and saving only to spend it foolishly elsewhere. So, now with the New Year upon us, take some time to plan your budget and get yourself and your finances organized.

Planning the Budget

My husband and I spent a good portion of the past week, as we do every year at this time, planning our budget for the next year. Having lived many years without a budget, we now know that we can never do without it. For us, we started setting up a budget during a time of unemployment. It was a scary time and it forced us to focus our attention onto exactly how much we spent. Honestly we were shocked and quite embarrassed at how much we were wasting. We were definitely living above our means and money was being wasted.

I’ll be honest, it wasn’t easy setting up that first budget. It was a rude awakening and we had to give up quite a bit. No more eating out, no more stops for coffee. Honestly, no more anything. But now, with our detailed budget, we know exactly what we spend and where our money is going and are ready for almost anything that gets thrown our way.

Handling Unexpected Expenses

Unexpected expenses happen so much that you can almost call them unexpected expected expenses. The only thing unexpected about them is you don’t know what they are or how much they will cost you. Like the time we had a leak in our roof and had to spend thousands of dollars to repair it. Or the time we had to remove dead trees so they didn’t fall on our house or our neighbors house. And, medical emergencies do happen! These are all things you can try your best to prepare for!

Importance of a Budget

Before budgeting, the unexpected expenses I mentioned above, would have been a nightmare for me and would have easily resulted in a slow pile up of debt. You see we wouldn’t have had that money just sitting around. So, we would have needed to charge it. What would happen next would be what would really send us into a tailspin. If we didn’t have the money to pay for those expenses, as they were happening, we wouldn’t have the money to pay them when the credit card bills would start to come in. That means paying small amounts monthly. And then, as other expenses would come up, we’d put those on the credit card as well. It becomes a vicious cycle of charges, interest payments and debt. Before you know, you are in so deep, you don’t know how to get out.

Free Living

That was how we used to live our life and it turned us into piles and piles of debt. But, not anymore. After 4 years of a super tight budget, and I mean super tight, we are now debt free and have been for the last five and a half years. We haven’t had a credit card in almost 10 years and we’ll never have one again. I know there are some of you that have credit cards and are disciplined with them. More power to you, but that was not us. We used them as an emergency and before long, everything seemed to be an “emergency”. Now, without debt, the weight that has been lifted from our shoulders is priceless. There are truly no words to describe the feeling of knowing where every penny goes and being in complete control of your finances. That, to me, is Living Rich!

So, with that said, I thought you might like some inspiration to get yourself on track with your grocery savings and budget planning. I pulled out some old articles I had written that seemed appropriate to start the New Year off on the right foot.

Resources to Help You Live Rich in 2019:

Living Rich Debt Free

See how a reader has made a difference by cutting her groceries and paid off her debt.

How To Set Up a Budget and Stick To It

Setting up a budget is not really on your top 10 100 things to do on a weekend, but it’s very important to plan. And if you spend one weekend doing it, then all your other weekends will be that much better. Check out 6 steps to set up your budget.

5 Easy Ways to Cut Your Grocery Bill

Just starting out with coupons? Check out how to get yourself on the right track to Live Rich with Coupons

Save $3400 a Year: 9 Easy Ways

Your savings don’t always have to come from the grocery store. Even a cup of coffee, or lack of, can save you a chunk of change for the year.

Zero to Stockpile Challenge

In 2018 I donated my entire stockpile to a local shelter and started from scratch! Follow my journey, check out tips and new things I learned along the way.

Grocery Savings Calculator

Track your savings at the grocery store with this awesome Grocery Savings Calculator through excel!

And, don’t forget to check out the Beginners Guide to Couponing